Embedding the 3 P’s into Every Team & Business Decision: People, Planet, and Profit

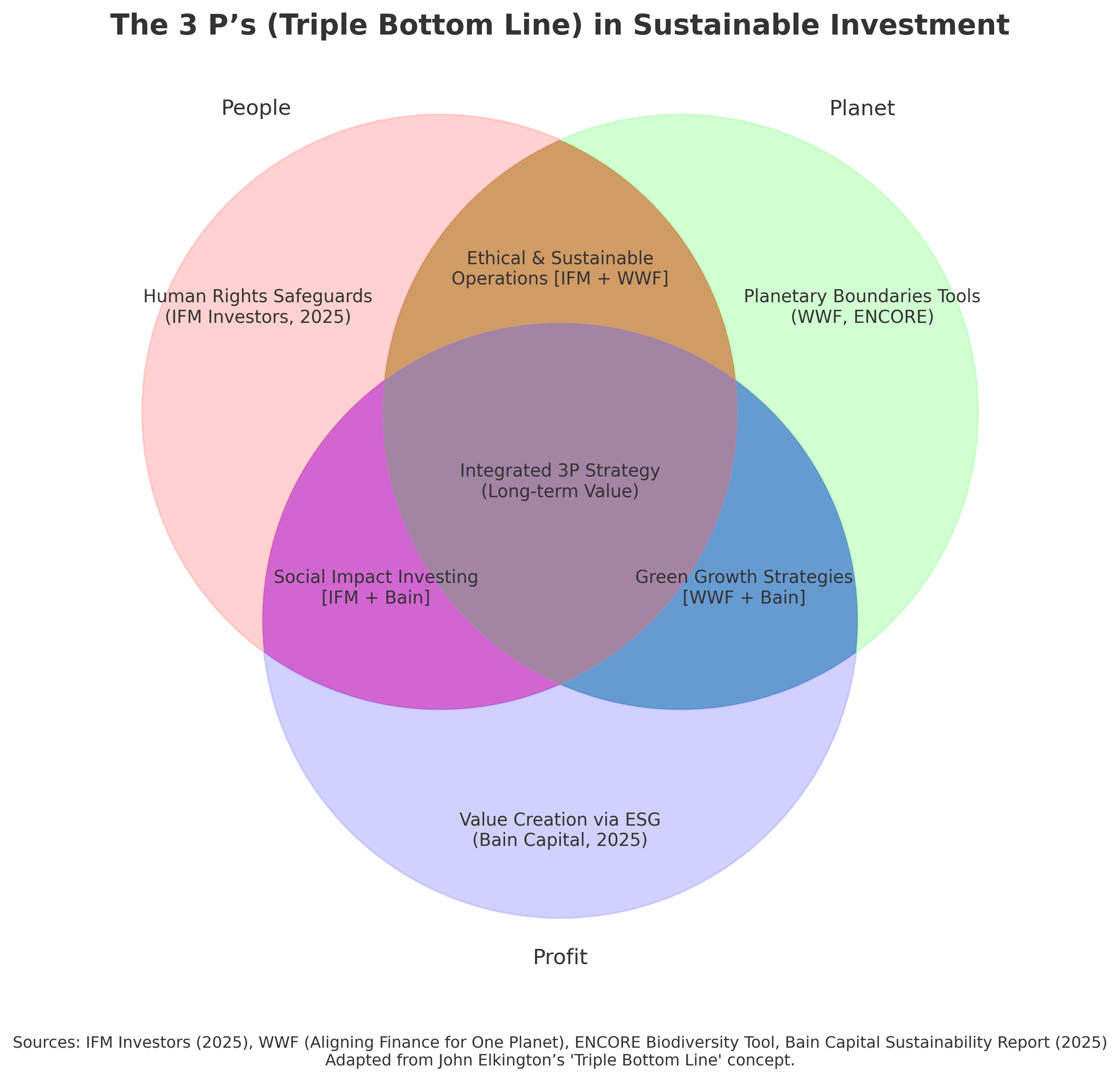

As global markets face mounting pressures from climate risk to human rights concerns responsible investing can no longer be treated as a niche or “nice to have.” The framework of People, Planet, and Profit offers a clear, actionable compass for aligning business and investment decisions with sustainable value creation. Ensuring the ‘triple bottom line’ as phrased by John Elkington.

Recent research and case studies show that when these three elements are considered together, the outcomes are more resilient, ethical, and financially robust. The latest IFM Investors report, Addressing Modern Slavery in Investment Portfolios (July 2025), makes this case convincingly, especially for the People pillar (IFM report PDF).

People: Protecting Human Rights as a Strategic Imperative

The IFM Investors paper underscores that modern slavery is not a marginal risk—it is systemic, far-reaching, and financially material. Beyond legal liabilities, it threatens brand trust, operational stability, and long-term value.

Their recommendations include:

Rigorous supply chain risk assessment models

AI-enabled data mapping

Third-party ESG frameworks and collaborative industry tools (e.g., KnowTheChain, WBA)

By actively addressing modern slavery, investors not only protect vulnerable communities but also strengthen the durability of their assets—proving that ethical responsibility and sound investment practice are inseparable.

Planet: Measuring Environmental Stewardship with Precision

Ensuring investments support a thriving planet means moving beyond surface-level ESG scores to science-based, absolute measures of environmental impact.

Frameworks like WWF’s Aligning Finance for One Planet assess whether portfolios remain within safe planetary boundaries, while biodiversity-focused tools like ENCORE help investors map dependencies on ecosystems and nature-related risks. Firms like Planet A Ventures go further, applying life cycle assessments (LCAs) to quantify environmental benefits from raw materials to product end-of-life.

These tools ensure that Planet considerations are measurable, not just marketing claims—helping investors avoid greenwashing while driving real-world environmental gains.

Profit: Sustainability as a Value Multiplier

The myth that sustainability compromises returns has been firmly debunked. In fact, Bain & Company’s collaboration with PRI and NYU Stern shows that integrating ESG can increase private value gains.

For example:

Bain Capital’s 2025 Sustainability Report demonstrates how they integrate climate risk assessments, sustainability-driven value creation plans, and “exit readiness” strategies to boost both impact and financial performance.

By embedding People and Planet considerations into due diligence, Bain has expanded exit options, improved resilience, and enhanced investor confidence—turning sustainability into a competitive advantage (Bain & PRI report PDF).

This reinforces the central truth: profit built on strong social and environmental foundations is more resilient, scalable, and attractive to the market.

Understanding and embedding the 3 P’s into team and work culture should be a Non-Negotiable Framework

For the 3 P’s to deliver lasting impact, they must move beyond boardroom strategy into the everyday mindset of individuals and organisations. This starts with education: integrating sustainability literacy, ethical decision-making, and systems thinking into school curricula, vocational training, and professional development. For example, the Ellen MacArthur Foundation partners with universities worldwide to embed circular economy principles into degree programmes, ensuring graduates enter the workforce with a 3 P’s mindset.

Equally critical is cultural embedding shaping organisational values, leadership behaviours, and reward systems so that acting in the interest of people and the planet is recognised as a driver of long-term profit. Companies like Unilever integrate sustainability KPIs into leadership scorecards, linking bonuses to environmental and social outcomes, while Patagonia empowers employees to spend paid time working on community and conservation projects. These initiatives show that when the 3 P’s become part of a shared language and set of norms, they shift from being a compliance exercise to a living framework one that guides innovation, inspires collaboration, and sustains trust across generations.

The lesson is clear: People, Planet, and Profit are not competing priorities—they are mutually reinforcing pillars of long-term success. IFM’s human rights safeguards, WWF’s planetary boundary metrics, and Bain’s sustainability-driven value playbook all point to the same conclusion:

Businesses and investors who fully integrate the 3 P’s into decision-making will not only protect what matters most but also unlock greater financial and societal returns.