Mission-Based Investing: Embracing Profit with Purpose.

Thought piece written by Sam: (5) Post | Feed | LinkedIn

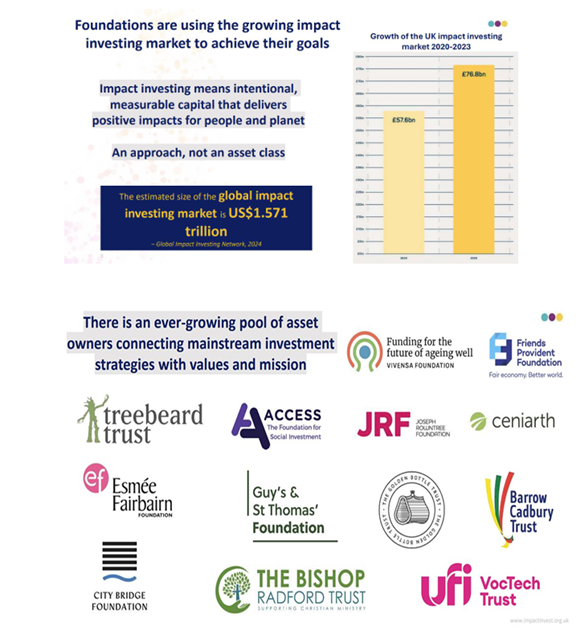

A notable trend is emerging as large endowments increasingly are going through a new wave of allocating funds towards mission-based investments (also known as impact investing), aiming to blend profit with purpose while targeting market-based returns. By the close of 2023, the UK impact investing market boasted £76.8 billion in assets under management, marking a substantial £19.3 billion surge from the previous report in 2021 (Source: Impact Investing Institute). However, when the next figures are published it looks like this figure will increase.

Recent developments highlight a renewed commitment to impact investing:

- Joseph Rowntree Foundation transitioned its entire £400m endowment to mission-based investments.

- Vivensa Foundation is actively seeking to invest in social impact initiatives, establishing a dedicated committee for oversight.

- John Ellerman Foundation is in the process of pivoting part of its Endowment towards mission-driven investments.

Key insights about the sector include:

- Impact investing presently represents nearly 1% of the UK investment market.

- The UK accounts for approximately 8% of the global impact investing landscape.

- Notably, private equity commands the largest portion of impact capital at 45%, then follows real assets at 28% and private debt at 11%.

- A promising outlook is evident as two-thirds of UK-based impact investors express intentions to increase or maintain their capital allocation towards impactful ventures in the coming five years.

As the market for mission-based investments continues to expand, the focus on strategies and funds catering to the evolving needs of asset owners continues. I still believe we are at the early stages of another leg of growth for the sector. Agree or Disagree?

Graph highlighting growth of UK impact investing.