Where does your fund or strategy sit in the Spectrum of Capital?

Author: Sam Mahtani

Where does your fund or strategy sit in the Spectrum of Capital?

I am passionate about impact investing and will be writing about this more in the coming weeks. In this post I go 'back to basics' to explain an important concept all investment professionals should understand.

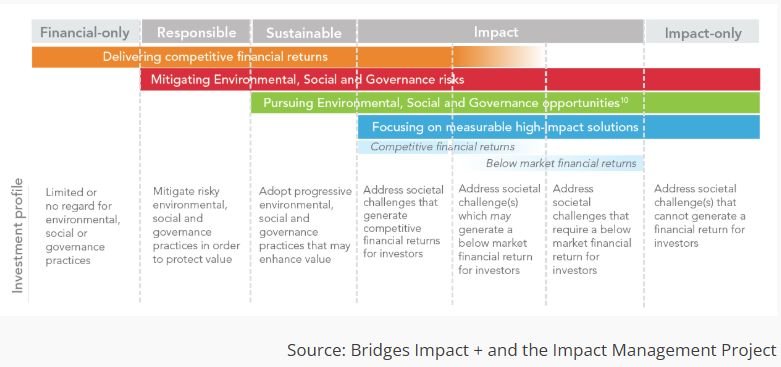

The spectrum of capital offers an extremely valuable framework for investors, social finance professionals, and businesses navigating the diverse landscape of investment options and impact profiles.

On one end of the spectrum lies the 'finance-only' approach, focusing solely on risk-adjusted financial returns without consideration for impact or environmental, social, and governance (ESG) practices. Evolving from this approach are 'responsible' and 'sustainable' investments, which align with the increasing expectation for money to drive positive outcomes alongside financial gains. 'Responsible' investments aim to address ESG risks and prevent societal harm, while 'sustainable' investments actively seek to create positive ESG impacts. Despite their different focuses, both strategies prioritise competitive financial returns.

Conversely, at the opposite end is the philanthropic approach, where capital is allocated to make impactful contributions towards solving some of the critical challenges that we face in society. While philanthropic investors do not anticipate financial returns, they conduct rigorous due diligence to ensure the efficient use of their funds and the maximum impact of their grants, aiming for significant outcomes while being mindful of past sectoral inefficiencies.

In the middle ground lies impact investing, combining elements from both ends of the spectrum. Impact investments direct capital towards measurable solutions addressing ESG and SDG challenges while also aiming for financial returns. These investments vary from 'finance-first' approaches that prioritize financial returns to 'impact-first' strategies that may involve higher-risk projects or below-market financial returns.

Question: Where does your fund or strategy sit in the spectrum of capital?

Investment profile across the impact spectrum.